According to the Corporate Finance Institute, corporate due diligence involves an investigation or audit designed to “confirm all relevant facts and financial information and to verify anything else” related to an investment deal. Completed before a deal closes, due diligence provides the buyer or investor with “an assurance of what they’re getting.”

The due diligence process is essential to conduct whenever considering a merger, acquisition, or other business investment. It can shed light on several factors that may influence whether you decide to pursue a deal or not – including hidden or ambiguous financial and legal liabilities that the company or its business owners may bring to the transaction. It can also help you as an investor determine whether you choose to proceed with a deal – or at least what the optimum terms and valuation are for the investment you are about to make.

During due diligence investigations, everything about the company you are doing business with should be transparently disclosed to you, from financial records, corporate structure and assets, insurance policies and claims, and legal liabilities to marketing budgets and plans, sales data, contracts, and intellectual property rights.

While documentation in each of these areas may be relatively straight forward to obtain, there is one aspect of due diligence that is a bit more complex and challenging to conduct – executive background checks.

If you are about to invest your time and put your financial resources and reputation at risk by involving or associating yourself with a company, you need to know who you are doing business with – and that you can trust what they say.

What to Look for in an Executive Background Check

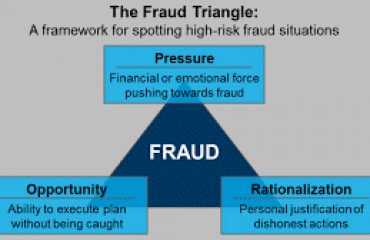

To assess the integrity and competency of potential business partners, you’ll need to take a thorough look at their past business dealings, professional and personal financial track record, patterns of behavior that either validate their character or call it into question, and any personal financial ties or liabilities that would be passed on to you as an investor.

When seeking out a partnering company to conduct these types of background checks, make sure you look for a licensed, credentialed firm whose employees operate with integrity, respect, and discretion. Also ask out the processes they undergo to conduct the due diligence.

In fact, there are many questions that should be answered to build an accurate profile of the executives you may partner with – and that means the firm you are hiring should gather data on several different fronts.

First, it’s important to obtain records on where company board members and C-suite executives reside – and have lived in the past – as well as any additional property or businesses they own. The firm should also check for both civil and criminal court records that could present risks or liabilities for you. The degrees and employment history of top executives with the firm should be verified as well.

The investigation should look at bankruptcies and at the driving records of executives as these types of data points speak to their behavior and overall character.

If there are divorces among top-level company executives, these records should be reviewed as well, as they typically include detailed information on a person’s assets and liabilities and would document whether an ex-spouse has a financial interest in the company you are evaluating.

Make sure you investigate whether any of the business owners have mingled their personal assets with the business at hand as this is a common practice, especially for early-stage start-ups in need of financing.

Why Partner with Subrosa Investigations

With more than 30 years of experience in conducting due diligence investigations, Subrosa’s deep expertise and reliable professionalism set us apart. Because we have worked across industries and geographies, we are able to customize our due diligence process to ensure you are well equipped with the right data you need to assess your investment opportunity and confidently move forward with an informed decision.

Through the discovery process, our dedicated investigators delve deep into records of the individuals being vetted to build a detailed profile on their reputations, finances, personal and professional conduct over the years, and any other obscured liabilities that they may bring to the deal that are material in nature. When we are finished with the due diligence process, you can rest assured, knowing who you are doing business with – and whether they are operating in a manner that is candid, honest, and trustworthy.

As a values-based organization, we treat every client engagement with the utmost professionalism, integrity, and respect – so that our efforts reflect well on you as the clients, are executed with humility and discretion, and ensure all contacts involved in our due diligence investigations are left with a good impression of us – and of you.

Discover how a Subrosa investigations can help you make more informed, data-driven investment decisions. Contact us for a free consultation today.